Australia’s consumer confidence edged up in July — while remaining in “deeply pessimistic” territory — as a cooling in monthly inflation encouraged the Reserve Bank to pause interest-rate increases.

Sentiment rose 2.7% to 81.3 points, meaning pessimists still heavily outnumber optimists with a reading of 100 the dividing line, a Westpac Banking Corp. survey showed Tuesday. The index plunged 17% over the first half of 2022 and has barely budged since then, holding in a 78-86 range, Westpac said.

“The responses suggest consumers are still clearly very nervous about the outlook for interest rates, particularly with the previous pause in April having been a ‘false dawn’,” said Bill Evans, chief economist at Westpac. “The key message is that sentiment is probably not going to stage a sustained lift from current deeply pessimistic levels until inflation is much lower and interest rates are firmly on hold.”

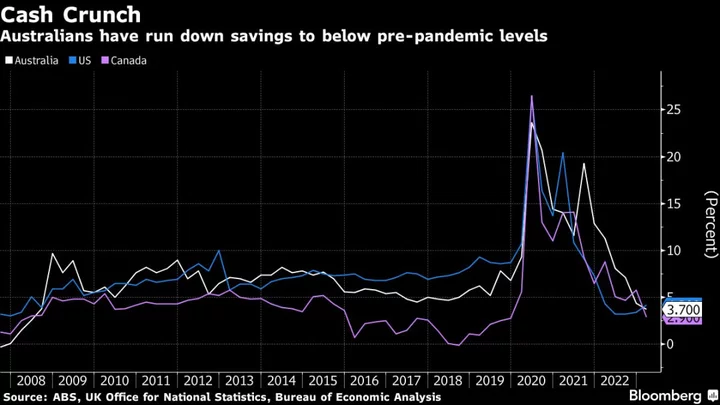

Evans pointed to surging living costs and sharply higher borrowing costs among the main drags on sentiment over the past year. “Our research suggests inflation has been the more dominant factor.” The poll was conducted between July 3-6, covering the RBA’s July 4 meeting when it left the cash rate unchanged at 4.1%.

The report showed assessments of “family finances compared to a year ago” fell 4.9% to 62.2, led by consumers on lower incomes and renters. The “family finances next 12 months” sub-index jumped 6.8% to 89.7, Westpac said.

A gauge of the outlook for household spending, “the time to buy a major household item” sub-index rose 3.1% at 78.8, while still holding around historically weak levels.

The Westpac-Melbourne Institute Unemployment Expectations Index continued to point to a loss of confidence around jobs. The index is up 32% since the RBA’s tightening cycle began in May last year, implying more Australians expect the jobless rate will rise in the year ahead.

Australia’s property market persisted in defying gravity. The House Price Expectations Index lifted by 1.8% to 149.3. “Consumer expectations for house prices continue to lift,” Evans said.